Corporations, Sustainability and CSR: How CSR can Inform Sustainable Behaviours

- salimaismayilzada

- Aug 23, 2024

- 5 min read

by Laurence Marzell, Serco and Simon Sølvsten, Willis Towers Watson

How can Corporate Social Responsibility (CSR) transform corporate behaviours towards long-term sustainability? This intriguing article delves into the powerful role of CSR in driving sustainable practices within businesses. By exploring insights from a comprehensive report on Green Building Neighbourhoods, we uncover how CSR initiatives, combined with Environmental, Social Governance (ESG) policies, can shift corporate focus from short-term gains to lasting community benefits. From the historical evolution of CSR to its modern drivers and practical applications, discover how businesses can leverage CSR to innovate sustainably and foster resilient growth. Join us on this journey to understand how CSR can be a catalyst for positive change and sustainable development in today’s dynamic world.

Emergent ESG – Environmental and Social Governance as a driver of corporate behaviours is integrally linked, in many respects to that of CSR – Corporate & Social Responsibility, but with a more acute focus on economic consequences, actual or perceived, due to negative ESG reporting. CSR could reliably be interpreted as the public face of ESG. Corporations have become increasingly active, some reluctantly some enthusiastically, in how they respond to this. The opportunity to leverage CSR, a mature discipline in corporations, to better support the wider umbrella of ESG, to drive sustainable innovation, development and transformation, or indeed, increased resilience, shouldn’t be overlooked.

A Short history. CSR is not new, its roots seen in organisations ranging from the Quakers, with their philanthropic approach to worker and community welfare during the industrial revolution to that of Britain’s Royal Navy, recognising that crew morale and wellbeing wins wars. These CSR roots had their zenith around the age of enlightenment as the industrial revolution drove population migration from rural to urban centres. However, the drivers and manifestation of CSR and other socially connected factors have changed alongside society and continue to do so to the present day. ESG being the latest manifestation as the world focusses on the planet and sustainability.

CSR Drivers. There are three principal and interconnected drivers of CSR in terms of sustainability. These are: practical factors, psychological factors, and cross-sector communication. At one end of the scale, psychological factors such as climate anxiety, risk aversion, and lack of access to information can make it hard for CSR to drive real changes in sustainability. At the extreme other, practical factors such as the availability of resources, including finance and the constraints these bring, for example across supply chains, which are a significant area of influence for CSR to encourage sustainable innovation and transition. Lastly, communication, especially between multiple different stakeholders who often exist within separate worlds, despite their underlying interconnectivity. A crucial element in achieving successful sustainability outcomes and one in which CSR can significantly influence.

CSR that is able to overcome these or is used to manage and positively influence these constraints, allows those dealing with practical challenges to give access to crucial information that policy-makers can use to change mindsets and drive better decision-making for sustainable behaviours and importantly, sustainable innovation. Whilst it is not necessarily possible to change an individuals worldview, by adapting information and evidence of risk to individual stakeholders’ preferred worldview, clearer communication not just of the necessity for environmental change but the level of incentive needed to instigate action may therefore be possible.

Either-or. Fortunately, it does not have to be an either-or situation. In fact, the risks associated with green innovation can be mitigated through CSR via changing behaviours whether consumers, citizens or across wider markets, supply chains and sectors so that there is a direct link between a company or organisation’s sustainability goals, practices, and policies, and specifically for the corporate world, their profit. The emphasis, being placed on assurance that sustainability does not have to be a word associated with risk. For example, consumer preference for greenness combined with times of high market volatility can actually increase consumer interest and uptake in green products and solutions. Data on observations such as this is still one of the key resources for providing stakeholders with better-informed understanding and an ability to action sustainability measures at all levels, including economically.

On the flipside. At the practical level, there are many financial constraints to sustainability that CSR can and should include strategies to mitigate. This is especially so working with SMEs (small to medium enterprises) as these often face increased consequences of corporate CSR implementation and have the greatest stake in the direct outcomes. For example, SME financing especially in relation to sustainable innovation is both a challenge as well as a huge opportunity.

Financing business contracts and operations, especially in respect to financing a transition to more sustainable practices, is often challenging for many corporations. For SMEs, this is especially so. With SMEs often the backbone of most economies, their role in driving sustainability innovation, development and change is crucial. While large corporations usually have no problem securing bank funding, SMEs often struggle to obtain the financing they need to grow and succeed. SMEs use various financing methods, including both informal and formal sources. Informal sources of financing include personal, friends, and family financing. On the other hand, formal sources range from venture capital, private equity funds, and angel investment to include financial institutions and commercial banks. However, despite the availability of formal financing options, SMEs are often challenged in accessing them and are therefore often driven down the informal financing route.

For instance, in the EU, the highest SME bank loan financing gaps are in the Netherlands (22% of GDP), Belgium (14%), France (9%) and Italy (4%). Since European SMEs depend on banks for 70% of their external financing (against around 40% in the U.S.), any gap between loan demand and supply could lead to lower investment growth if companies don’t have the means to self-finance their investments. Tackling these challenges, by a focus on supply chain finance, is just one of the areas in which good CSR has a role to play and should accommodate the reality of risk and reward for stakeholders on the ground across the supply chain.

The World Economic Forum describes the ‘burden of sustainability’ as a way of encapsulating the risks and potentially relatively low short-term rewards that come from transitioning to sustainable development practices. However, a holistic CSR strategy must take into account and emphasise the ‘burden’ part of this phrase, recognising the risks that are associated with the uptake of innovations towards sustainability. Furthermore, it must account for the barriers associated with sectors working together. An interconnected CSR approach that accounts for this and looks at the relative resources and rewards for stakeholders across the ground and associated supply chains can share the sustainability burden, and this mitigates risks for the actors involved.

Stakeholder Outcomes. Companies that prioritise CSR and sustainability often enjoy a positive brand reputation, which can attract customers, investors, and talent. Investors are increasingly looking for companies that demonstrate a commitment to environmental and social responsibility, in other words, good ESG rating and reporting. Furthermore, by understanding the needs and preferences of consumers, companies can develop products and services that meet sustainability criteria and contribute to a more sustainable future. At the heart of it, good CSR can synthesise the psychological and the practical limitations on driving green innovation, bringing stakeholders with conflicting views together to be able to have a greater diversity of options in an increasingly changing world.

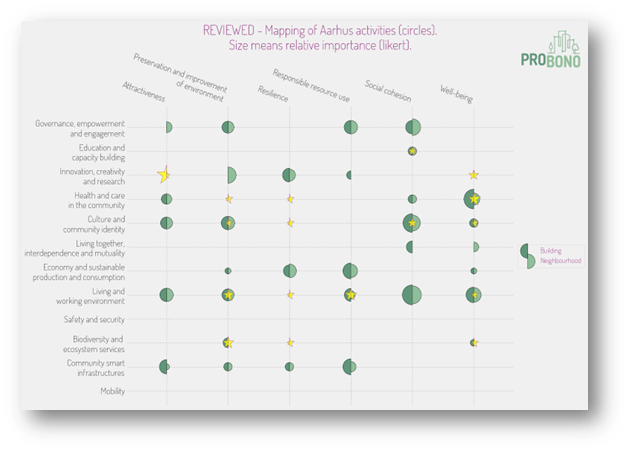

This short article takes its cue from a PROBONO deliverable report in support of the development of GBNs – Green Building Neighbourhoods. The report looked at the Governance and Incentive Opportunities linked to Corporate Social Responsibility and the drivers and enablers to change corporate mindsets from short term goals, towards long-term sustainability. Identifying incentives and policies, such as Environmental, Social Governance (ESG) and EU finance and investment disclosures, to link long-term goals with actions and behavioural changes able to more closely link organisations and communities through changes in Corporate & Social Responsibility (CSR) that could have a positive impact on local communities. Read more.

Comments